Ways to Reduce Tax Liability: How to be Tax Efficient

By: Carter Pike

Taxes are fundamental to society. They fund essential government services, infrastructure, etc., but no one wants to pay more taxes than necessary. Fortunately, there are legal and ethical ways to reduce your tax liability and keep more of your hard-earned money while staying in compliance. Here are 8 tax-efficient strategies:

- Maximize Tax-Advantaged Accounts: One of the most effective ways to reduce your tax liability is to take full advantage of tax-advantaged accounts. 401(k)s and IRAs offer tax benefits that can significantly lower your tax bill. Contributions to these accounts are often tax-deductible and can grow tax-free until you withdraw the funds in retirement. By contributing as much as possible to these accounts, you can reduce your taxable income substantially.

- Plan Your Retirement: Retirement planning isn’t just about saving for the future; it can also help reduce your tax liability for the future. Contributions to retirement accounts like Roth 401(k)s and Roth IRAs require earned post-tax income. This is great for when you reach retirement age, as you may be in a higher tax bracket, but receive gains and withdrawals tax-free.

- Invest Wisely: Investing with a tax-efficient strategy can also reduce your tax burden. By holding investments for the long term, growth from assets held for over a year is often taxed at a lower rate than short-term holdings. Certain investments are also better than others, as index funds and ETFs typically have fewer taxable events than actively managed funds.

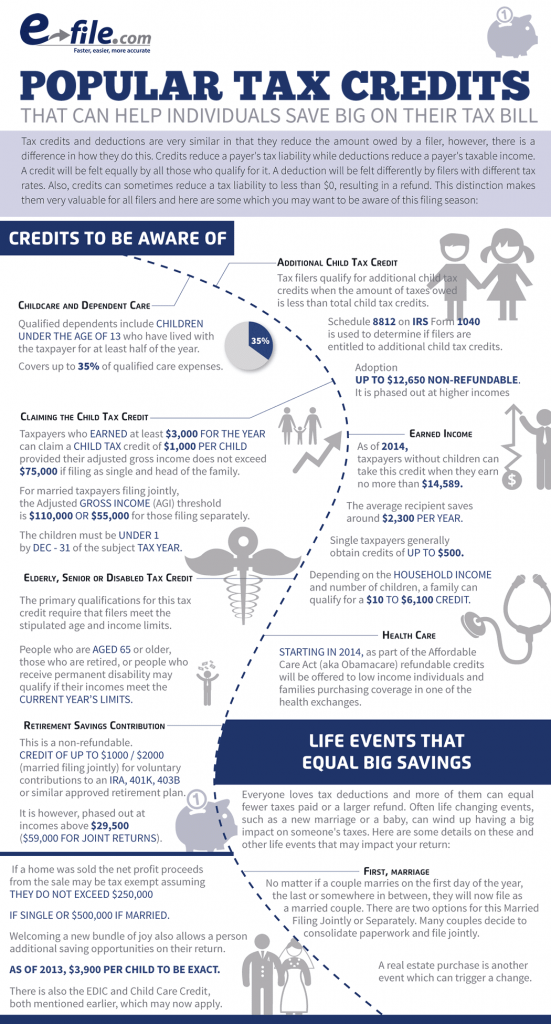

- Take Advantage of Tax Credits: Tax credits are powerful tools to help you spend less money on taxes and more where it matters. Credits are available for specific, individual purposes, such as education, childcare, and even energy-efficient home improvements. Find what credits apply to your needs and save, as they directly reduce the amount of taxes you owe.

- Charitable Giving: Donating to charitable organizations not only helps good causes but can also provide a tax benefit. You’re killing two birds with one stone! Giving to qualified charities may be tax-deductible when making donations of cash, property, or appreciated assets. This works to reduce your taxable income, so you are paying taxes on less. Less income, less taxes.

- Home Ownership: If you own a home, there are substantial tax benefits available to you. Utilizing mortgage interest and property tax deductions can significantly lower your taxable income. Also, if you sell your primary residence within certain guidelines, you may be eligible for a capital gains exclusion of up to $250,000 for individuals or $500,000 for married couples filing jointly. That’s half a million dollars!

- Tax-Efficient Business Strategies: Now, if you are a business owner, structuring your business as an LLC or S corporation could have some amazing tax advantages. These structures can provide, what is called, “pass-through taxation,” potentially lowering your overall tax rate. Additionally, businesses may also have deductions and credits available, so work with a specialized tax professional to optimize your tax strategy.

- Keep Impeccable Records: It’s simple; keep every tax-related document. Maintaining thorough financial records is essential for minimizing your tax liability. Proper documentation of deductions, credits, and income sources is crucial to claim eligible tax breaks and defend against the unfortunate scenario of an audit. And nobody wants an audit. Nobody.

Reducing your tax liability is not about evading taxes or taking part in illegal activities; it’s about making wise decisions and taking advantage of the many legitimate opportunities the tax code offers. By maximizing tax-advantaged accounts, investing wisely, and utilizing tax credits and deductions, you can keep more of your money in your pocket, all with a clean conscience and record. Tax planning is a year-round endeavor, so don’t let poor planning come back to bite you! Consult with a tax professional to ensure you’re making the most of every opportunity to reduce your tax burden. We as believers are called to “give to Caesar what belongs to Caesar,” (Matthew 22:21), so only give him what is required 😉

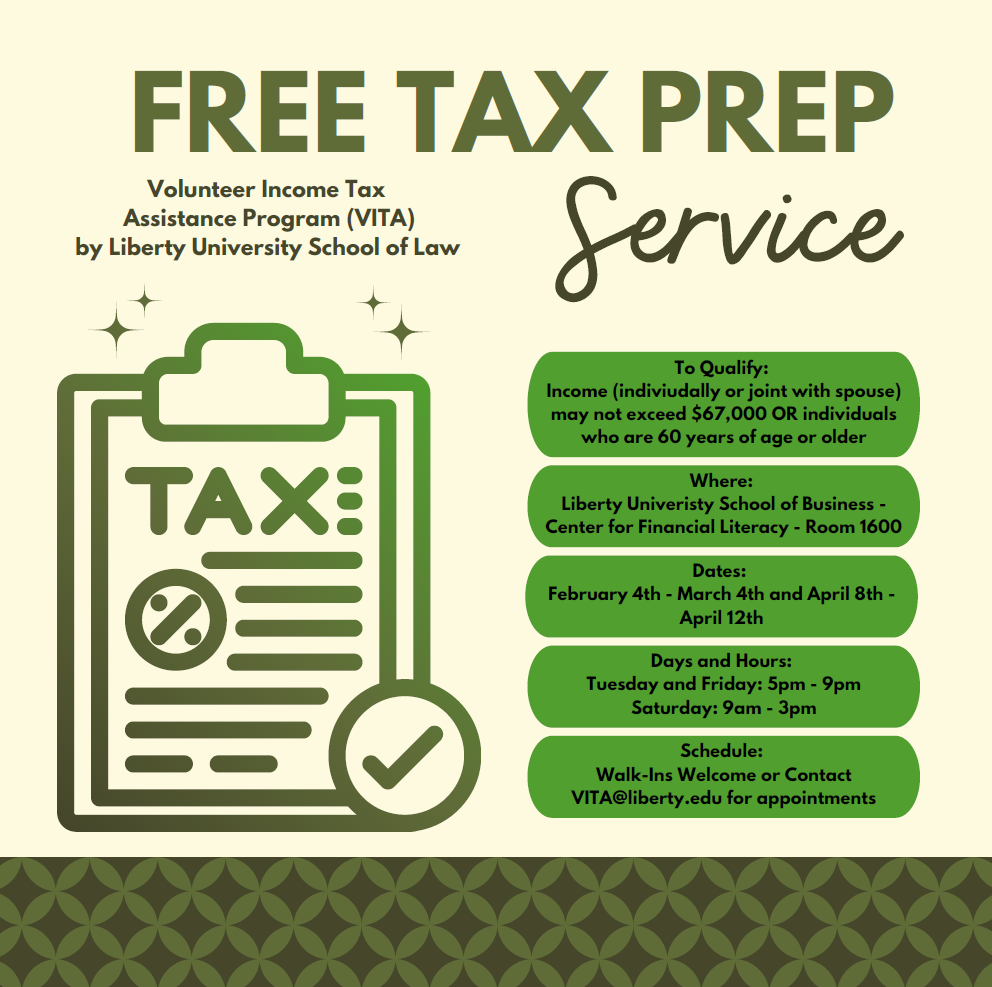

Local to Lynchburg and interested in free tax prep? You may qualify to use the VITA tax clinic offered by Liberty University School of Law.