Heart, Health, Habits, & Hope

By Eliza Reinmund

Finances, for many, can feel like a cloud of confusion. I’ve definitely experienced this, not knowing where to start or what to focus on. Money is so deeply involved in almost every aspect of our lives, which makes it difficult to discuss, but so important to understand.

Ron Blue, founder of Blue Trust helps us to break down the intricacies of money using something called the Four Hs Tool. “The Four Hs of Financial Wisdom tools are designed to equip people with an understanding of the four basic money conversations: HEART, HEALTH, HABITS, HOPE. Imagine what life would be like if we all had a better grasp not only on how we manage our money but the why behind it.

The HEART conversation focuses on the ways that our heart attaches itself to the treasures of this world. Matthew 6:21 says “Where your treasure is, there your heart will be also.” Where does our treasure lie? With this conversation in mind, there are four major perspectives to consider:

Stewardship: Do I believe that God owns it all?

Contentment: Do I believe that what I have right now is enough?

Faith: Do I believe that I demonstrate my faith through my finances?

Wisdom: Do I believe that God’s wisdom is true and available?

Answering these core questions gives us insight into the condition of our hearts because “behavior follows belief”.

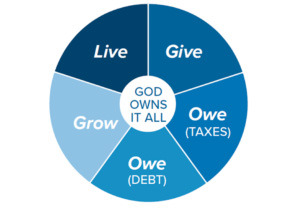

The next conversation centers around our HEALTH in the context of money. It is based on the idea that our money is disbursed into one of five categories:

Live: spending money on necessities for your day-to-day life

Give: giving out of abundance and sacrificially

Owe (debt): “the borrower is slave to the lender” (Proverbs 22:7)

Owe (taxes): proof of God’s provision; you pay taxes because you have income

Grow: placing a focus on the money you will need in the future

Having a good grasp on each of these categories and how they interact with one another is important. A dollar that you spend in the live category is a dollar you, in turn, can’t use in the give category. It all comes with opportunity cost, as “there are no independent financial decisions” (Ron Blue Trust).

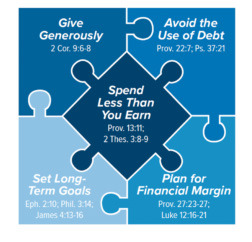

The third conversation has to do with our HABITS. It is vital that we know how to control our habits before they begin to control us. There are 5 core habits that stem from biblical principles:

Together, these habits work to set a guideline for the way that we live, bringing about a more peaceful lifestyle overall. Spending less than you earn is the key component that allows for each of the other habits to take root.

Lastly, we focus on HOPE. Jeremiah 29:11 says, “’For I know the plans I have for you,’ declares the Lord, ‘plans to prosper you and not to harm you, plans to give you a hope and a future.’” Our future depends on the margin that we built up (one of our habits). We need this buffer to respond to the calling that the Lord has placed on our lives. Typically, we fall somewhere on the following spectrum of what Blue Trust calls the “Margin Meter”:

Where do you think you fall in each of these 4 conversations (heart, health, habits, hope)?

Do you feel like you are struggling to make sense of the complicated world of finances?

You are not alone. Tools like these are created because of the amount of people who need clarity on this topic. But also, this is to be used as a tool, not a rulebook. We should always be praying and asking God to show us where we can grow in each area of life.

I hope this was as encouraging for you as it has been for me as I navigate these difficult conversations. I would prompt you all to really dive in and start to unpack the intricacies that lay behind the four Hs: HEART, HEALTH, HABITS, and HOPE!

Resources:

Ron Blue 4 Hs Tool: https://ronblueinstitute.com/fourhtool/

https://www.biblegateway.com

https://www.youtube.com/watch?app=desktop&v=R8pnsJwW4-U