Everything Liberty students should know about Biden’s student loan forgiveness plan

President Joe Biden announced his administration’s student loan forgiveness package Aug. 24, which will provide targeted debt relief to low-to middle-income borrowers. He also extended the pause on federal student loan repayments through Dec. 31, 2022.

Students are advised to budget accordingly as payments are slated to resume Jan. 1, 2023.

With $1.6 trillion in accumulative student loan debt divided among a pool of more than 45 million borrowers, the president’s multibillion-dollar bundle fulfills one of Biden’s longstanding campaign promises.

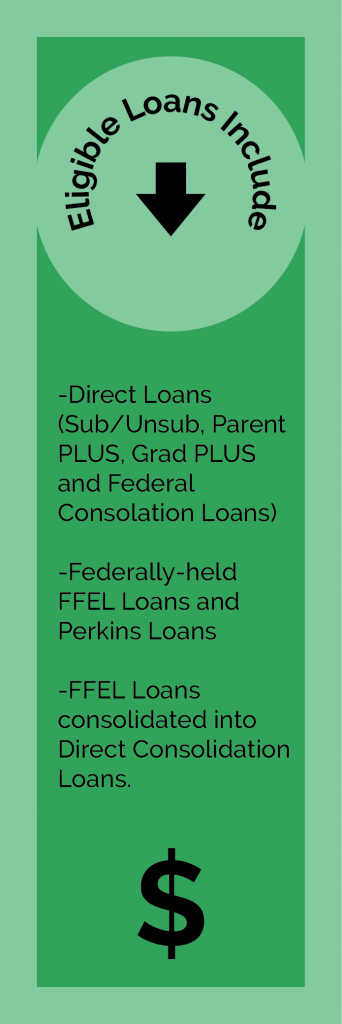

Those eligible include individuals making less than an annual income of $125,000 and married couples making less than $250,000. The Department of Education will cancel up to $20,000 for Pell Grant recipients and up to $10,000 for non-Pell Grant borrowers.

According to Biden, this decision stemmed from rising tuition rates throughout the decades. Costs to attend college lingered at roughly $10,000 annually in 1980, which included room and board. Today, that figure has nearly tripled to $30,000 each year.

“Twelve years of universal education is not enough, and we’re going to be out-competed by the rest of the world if we don’t take action,” Biden said in a Aug. 24 press conference. “The cost of education beyond high school has gone up significantly.”

“The pandemic only made things worse,” Biden added. “But we’ve responded aggressively to the pandemic to minimize the economic impact of the harm of COVID imposed on individuals, families and businesses.”

For students who made payments during the pandemic moratorium period (March 2020 – present), a refund is available. Liberty is advising students to speak with their loan servicer on refund eligibility.

“I can tell you with 100% certainty, students are getting refunds on payments made during the pandemic,” Ashley Reich, the executive director of Government Affairs at Liberty University, said.

Students requesting a refund on payments made during the pandemic should contact their loan servicer, confirm payments made during the pandemic and expect to see reimbursements trickle into their bank accounts after four to six weeks. Each reimbursement will be refunded separately and not in a lump sum.

While Biden’s student loan forgiveness package may temporarily provide alleviation for some, Liberty is encouraging students to adopt biblically-sound financial principles as they practice their degrees.

One of Liberty’s many services include the Center for Financial Literacy, where students can receive financial coaching, guides for budgeting, saving and investing and learn how to manage student debt while pursuing a degree.

“Being prepared is really important, and planning is really important,” Reich said. “We want what’s best for our students, and we want them to be successful in their degree fields here at Liberty. But ultimately (we want them) to graduate, go out and become a citizen and get a job.”

Students should prepare to resume student loan payments beginning Jan. 1.

Smith is the news editor for the Liberty Champion.