Before Completing A Budget Transfer

Budget transfers are a valuable tool for all budget managers. To make this tool even more useful, the Financial Planning & Budget (FP&B) office will be adding your justification and other important information to the document text of your transfers at the time of FP&B review and approval.

Benefits of providing additional justification are as follows:

- Completing base budget substantiations for the next fiscal year will be a smoother process.

- Safeguards funds that may be needed for other purchases that are also important to your department’s goals.

- Ensures funds are being spent as planned.

- Transferring funds may not be necessary – a budget amendment may be required.

Questions to be Answered

Answering the following questions will allow FP&B to add proper and sufficient justification to your documentation:

1. Is this transfer a pre-planned expense?

- IF YES – Where is the expense budgeted and why is funding not in the right place?

- IF NO – What other pre-planned expense is the department forgoing in order to fund this expense?

2. Is this a permanent or temporary transfer?

- Use BD2 if the transfers should become part of the base budget in future years (funds are for an annual reoccurring expense).

- Use BD4 if the transfer is for a one-time expense (not to become part of the base budget).

Research for Answers

Review the line item that funds are coming from and determine the original intentions for those funds.

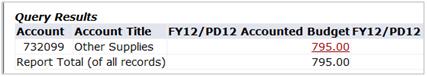

Step 1 – Drill down into the budget column for the account you are planning to use.

Step 2 – Identify what expenses/activities are funded in the account.

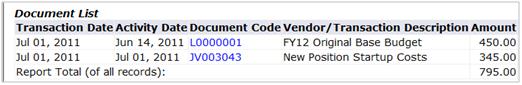

- If the funds are part of the original base budget, refer to your organization’s base budget in Anaplan and look at the Justification/Substantiation for the account code.

- If the funds are not part of the base budget, refer to the document text of the entry and/or the original documentation (BRF or Budget Amendment Form).

Step 3 – Determine if any of the following statements are true.

- Funding in this account is intended for the same expense/activity but is in an incorrect account/budget.

- The department is willing to go without this expense/activity and will not need these funds later on in the fiscal year.

Note: If the department historically spends the money in this account, justification will need to include how operations have changed to accommodate this move. For example, “The department has historically spent $5,000/year in postage but has converted to electronic communication so postage is no longer necessary.”

Step 4 – Decide whether to submit a Budget Transfer or Budget Amendment.

- If any of the statements in Step 3 are true, complete a Budget Transfer using ASIST or the Budget Adjustment Tool and email a copy of your justification along with the document number to your Budget Analyst.

- If neither statement in Step 3 is true, submit a Request for Budget Amendment Form.

Is a Budget Amendment the Right Process?

It may be that a Budget Amendment is a better route:

- If the purchase was not planned as part of the base budget;

- If the funding need is not an approved item on the BRF;

- If funds for this expense were not allocated in any other account code; and

- If there is no other expense that the budget is able to forgo to free up funds.

Request for Budget Amendment (updated April 2021)