The rejection of the proposed Keystone Houston Lateral Project reveals questionable political motives

What comes to mind when you think of Canada? Moose? Mounties? Maple syrup? Something else that starts with an “M,” perhaps?

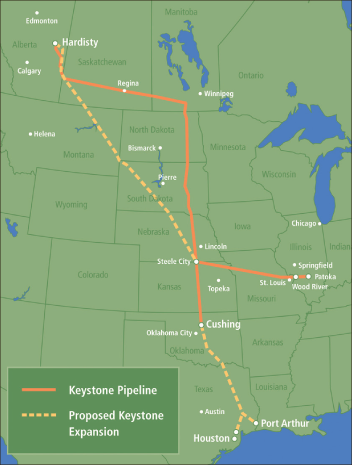

Reaching the Gulf — The proposal extends the current pipeline completely through the continental U.S., allowing access to numerous refineries. Graphic credit: Global Labor Institute

Right now, however, the “M” word you should be thinking of is “money,” oil money specifically.

First, a quick primer for those not familiar: Keystone XL is a proposed expansion of the preexisting Keystone Pipeline system owned by the TransCanada Corporation, which, according to the energy company’s website, pumps synthetic crude oil from the Athabasca Oil Sands in Alberta, Canada to the Gulf Coast, in addition to locations in Illinois and the Midwest.

Unfortunately, there are several problems with Keystone XL in its current form. A whole other article could be written on the potential environmental impact of the pipeline, so for brevity’s sake, this piece will focus on the economic side of things.

The pipeline’s stated goal, as the StarTribune’s Phillip Verleger points out, of this new pipeline is to circumvent refineries that refuse to accept a hike in prices. In his article, Verleger goes on to explain that back before the uptick in Canadian oil production, Midwestern refineries had to pay more for the same product than refineries in southern states because the oil had to be shipped north, rather than south, as it is now.

If Keystone XL is built, production will shift directly to the Gulf Coast, and northward shipping will resume, driving up prices for those refineries, passing the costs on to the consumers in those regions, according to tarsandaction.org, a website created to petition the XL Pipeline.

The change in cost is intentional, and to assert so is not some vaguely conceived conspiracy theory. The evidence comes straight from the mouth of the TransCanada Corporation. As the Natural Resource Defense Council’s Anthony Swift points out, TransCanada told the Canadian National Energy Board that it would make up the extra shipping costs and then some by increasing the amount Americans pay for Canadian oil by $3.9 billion.

Knowing this, how could any American politician in good conscience support such a proposal? But as USA Today reports, President Obama has rejected it. Because Republicans refused to extend the payroll tax cut unless he approved the pipeline or explained why it was not in the national interest, Obama argued that not enough time had been allowed to consider other routes.

Speaker John Boehner, on the other hand, has been a fierce advocate of the pipeline. And why wouldn’t he be? According to his financial disclosure forms, the Washington Post reports Boehner has personally invested between $10,000 and $50,000 in companies with a stake in Canadian oil sands, including six oil companies and one electric company.

But according to a FOX News article, Boehner also tried hard to downplay these claims by further explaining his views on the matter.

“The speaker wants to increase the supply of American energy and reduce our dependence on foreign oil, and he is only interested in reforms that actually lower energy costs and create American jobs,” Boehner spokesman Brendan Buck said in a statement to FOX News, adding that it was this focus that has caused a conflict between both political parties and resolving the problem with the cost of energy resources.

A casual observer can see the conflict of interest between Boehner’s actions and his words. But, when asked about the subject, his personal spokesman continues to deny any such thing, arguing that Boehner has no hand in day-to-day trading.

“I have not made any decisions on day-to-day trading activities in my account and haven’t for years,” Boehner said in a news conference earlier this month. “I do not do it, haven’t done it and wouldn’t do it.”

Regardless of his statements, it is obvious that there is a lot that he is not saying. But, for the time being, only time will tell if Boehner is actively searching for a way to keep oil prices down — or further lining his own pockets.