While college students lead busy lives, scrambling to complete schoolwork and arrange their upcoming careers, they often live under financial stress.

Their time is eaten up by academics, they do not yet have a degree to get a high-paying job and student loans are burgeoning like anvil-shaped thunderclouds overhead, ready to strike after graduation. Yet in the meantime, they have to pay for housing, books, groceries and some necessary caffeine.

“It’s really hard to do college and not come out with tons and tons of debt, especially somewhere like Liberty (University),” Sarah Douglas, a graduate student, said. “It’s a great school, but it’s really expensive.”

So what is one to do? Some Liberty students have found innovative ways to bring in a little extra cash.

Giving the Very Blood in Your Veins

Douglas was a residential undergraduate student from 2012 to 2016, and she experienced a stressful financial squeeze. For a while she worked at the Hardee’s close to campus, but later quit because she felt it took too much of her time from academics. She was on the edge of failing a subject she was skilled in.

“It really affected my mental health a whole lot,” Douglas said. “It affected my grades a lot. I was a straight-A student in high school and in the first couple years of undergrad, and then by my senior year I was like, ‘Just let this be over.’ … It was so much to worry about with classes and with work at the same time.”

So Douglas found other small ways to bring in some money. She treated her textbooks carefully and then resold them at the end of the semester. She found any other belongings she did not need and sold them through a Facebook group and through the now-defunct Half.com.

She also began donating plasma at the local Octapharma Plasma, where one can donate up to twice a week and pay is based on time, amount of plasma donated and other factors. For Douglas it provided a steady supplemental income.

“It’s scarier (than donating blood) and it’s a weird feeling, too,” said Douglas. “If I hadn’t known people who had done it, I probably never would have done it.”

Today Douglas takes Liberty University online graduate classes from her home in Arizona. Once she graduates and finds work as a teacher, she plans to advise her students to attend community college first and transfer later.

“I want them to learn from — I don’t want to call them mistakes — but I want them to learn from, ‘This is what I did and it was really stressful and hard, and here’s what you can do differently to make it a little less stressful for yourselves,’” Douglas said.

Resale and (Almost) Relaxation

Kylar Pardon is a busy Liberty undergraduate who has a work-study job but says it is not enough.

“I’m making nothing (through it), honestly,” Pardon said. “I can barely afford rent.”

Pardon has found his answer in reselling books on Amazon.com. He is especially strapped for time this year, his last before graduation.

“I’m taking 18 credit hours, I’m doing financial coaching (as a peer coach), I have a 15-hour work-study and I have friends and a social life,” Pardon said. “So where do I have time to actually do my business? I don’t.”

Pardon uses Fulfillment by Amazon (FBA), a service for sellers on Amazon.com in which the internet giant handles a portion of the work. Pardon is the one who finds the books, lists and labels them, decides on the resale price and sends them off in bulk to an Amazon distribution facility. Only then do the items become “active” on the market.

Amazon handles the individual sales, shipping, returns and interactions with customers. In return they keep roughly 35–40% of the commission, according to Pardon.

Pardon goes to library sales and thrift bookstores armed with a scanner and a phone app which tells him a book’s market value. He sometimes brings home dozens of books at a time.

Being an FBA member means that Pardon can do the work of putting hundreds of items up for sale in the summer and then passively receive income during the school year. Despite Amazon’s commission and the $40/month subscription it takes to be an FBA seller, Pardon says that “the return is insane.”

“I was at the local Goodwill, and I guess students just donate their textbooks. I got two textbooks,” Pardon said. “One was worth $120 and the other was like $80, and I spent $3.”

Getting Crafty

Other students have found more hands-on, artistic methods for making money.

For graduate student Victoria Dissmore, creating her own business flowed naturally out of her love for making jewelry. Since she was little, she would use yarn, chain, wire, buttons or whatever she could find to make fun, decorative pieces.

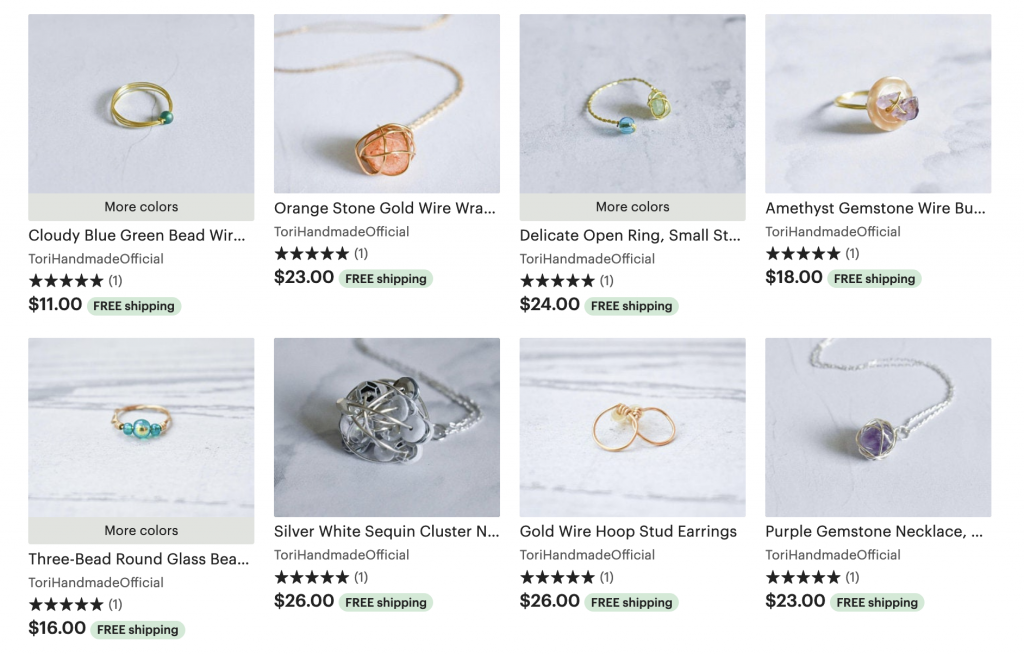

CREATIVE — Dissmore’s Etsy store provides an extra source of income and an outlet for her hobby.

In high school, she realized her hobby’s potential for profit.

“People kept asking me if I was selling them, if I could make them one. So then I thought, ‘Okay, maybe I could make this into a business,’” Dissmore said.

Online craft marketplace Etsy.com requires sellers to be 18 years old, so Dissmore did not wait a day past that birthday to set up her own shop, called Tori Handmade.

Etsy remains Dissmore’s main outlet for her artwork, though she has also been a vendor in farmers markets and craft fairs.

“Running a business is no joke, especially for one person,” Dissmore said.

For her senior year of her undergraduate career, Dissmore decided she had to shut down the business in order to have sufficient time for her classes. Now, however, she is focused on growing it.

These days, balancing school and work comes much easier, and Dissmore is planning ways to increase advertising and open new lines of products.

“Hopefully this will end up being my full-time job one day,” Dissmore said.

Editor’s Note: This story was written last fall. The status of those mentioned may have changed.

McClamroch is a copy editor. Follow her on Twitter.