Liberty University Center for Financial Literacy seeks to help remedy debt problems with Ron Blue Library

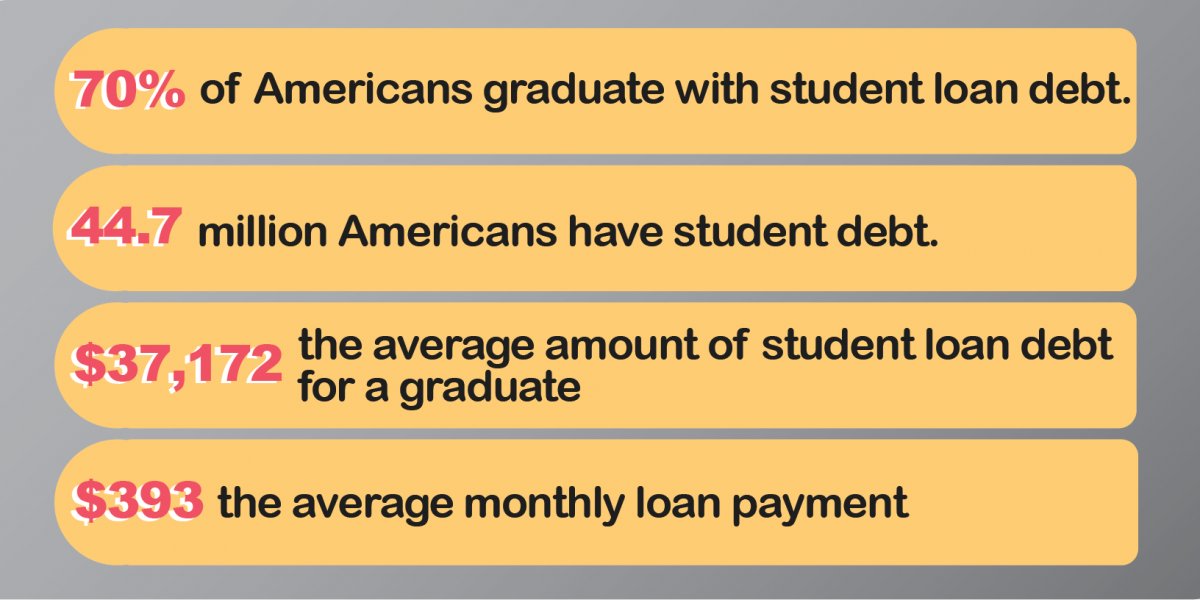

As the national accumulation of student debt continues to skyrocket, accreditation bodies now require universities to address student debt. The Center for Financial Literacy (CFL) at Liberty University seeks to help remedy this debt problem through its partnership with the Ron Blue Library.

Stacie Rhodes, executive director of the CFL at Liberty, said the CFL exists to prepare students with financial wisdom based on Ron Blue’s biblical principles on financial wisdom.

With over 40 years of experience, Blue is widely considered the father of Christian financial plan-ning and owns one of the largest Christian financial planning firms in the United States. Blue spoke to the faculty in August 2018 on how to integrate financial principles in their courses.

“I really don’t think that true financial change is going to happen until you get to the education level,” Rhodes said.

Blue distributes his “Simplifying the Money Conversation” curriculum because of his passion for educating college students on biblical financial principles. Through a program of “education, collaboration and the integration,” Blue’s goal is to simplify the conversations about money.

Blue’s financial literacy curriculum has been implemented in over 140 classes across each degree program and has reached thousands of undergraduate students already. The CFL hopes to extend the program to online and graduate students soon.

CFL — Stacie Rhodes is the executive director of the Center for Financial Literacy at Liberty.

“Students are in the place where they are literally stepping into the next chapter of their life that is going to set them up for incredible success or a (difficult future). The decisions they make today (will) affect their future,” Rhodes said. “It’s inevitable.”

The CFL focuses on the four H’s: heart, health, habits and hope. This principle-based approach looks at finance from a biblical perspective and encourages students to be stewards, rather than owners, of their money.

“There are (over 2,000) verses in the Bible about money,” Rhodes said. “Material and pos-sessions are just a significant thing that God talks about. Unless we grasp this at this prime age … then you are really just missing out on God’s faithfulness and (the opportunity to) steward his money that he has entrusted (us with) in a very

good way.”

When it comes to money, Rhodes said having the right perspective shapes wise financial actions.

“Until we have a good perspective and a grounded perspective on what the Bible says about money and how we should manage it, we’re really not going to set ourselves up to truly manage our behavior,” Rhodes said. “We have to get to the core of what we truly believe.”

The newly-established T3 club through the CFL allows for open dialogue about money and is open for students of all majors. Next semester, the CFL will offer peer-to-peer financial coaching for students to engage in important money conversations.

“Imagine if believers grasped (financial literacy), the anxiety that would melt away, the funding that would be available for missions and for other incredible opportunities, just to spread the gospel if people started managing their finances well,” Rhodes said. “Our champions for Christ should be able to go and serve (in) their calling because they have a grasp on their finances (and) they’re not in a lot of debt.”

For more information on the CFL, financial workshops, free resources, peer-to-peer coaching or the T3 club, visit www.liberty.edu/cfl.

“In order to train a champion,” Rhodes said. “We have to equip them in every area .”